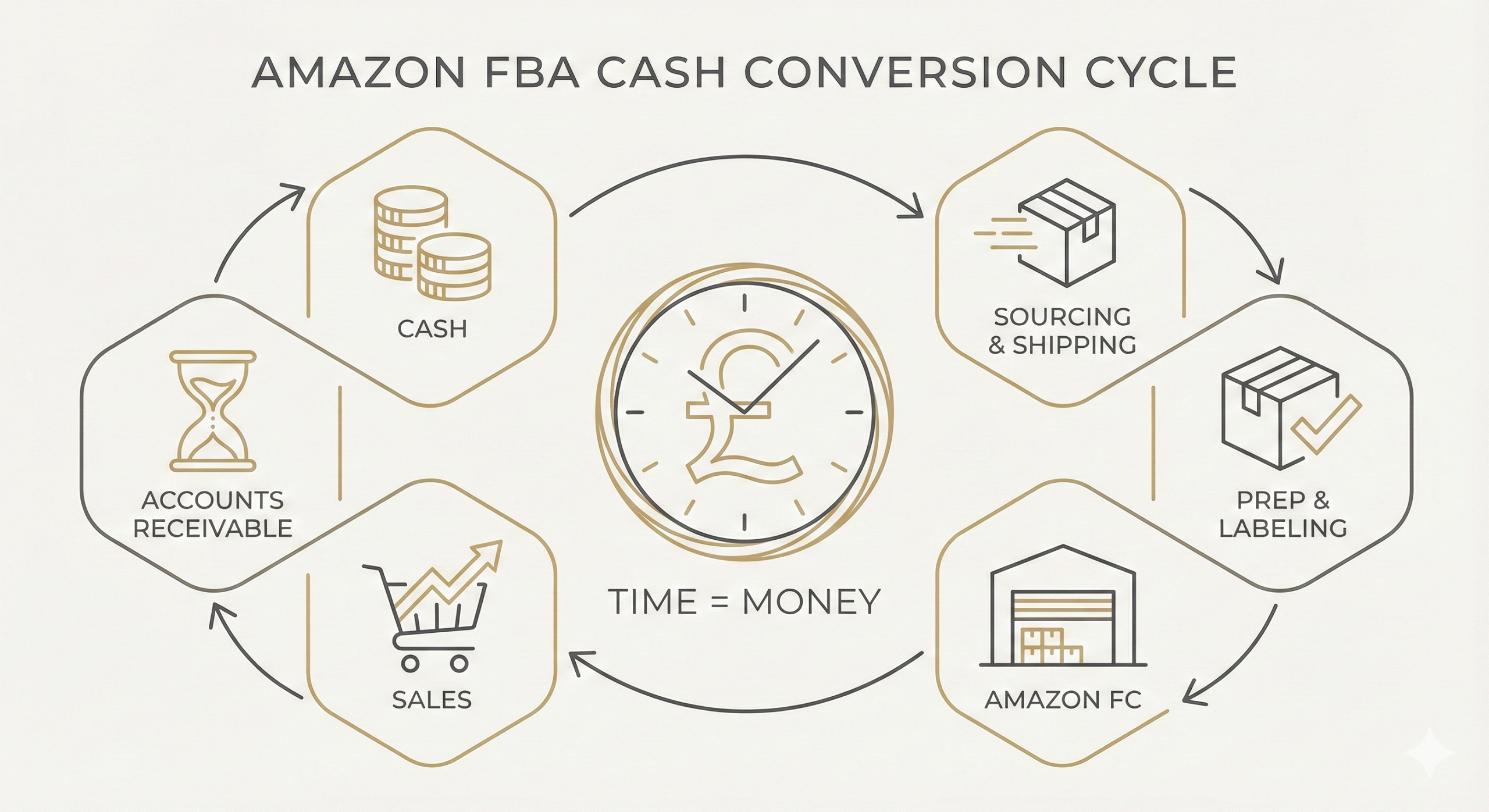

The Money Cycle: Pure Compounding Why Speed Matters More Than Margin

Most sellers obsess over profit margins. Smart sellers obsess over Velocity. See how shortening your Prep Time accelerates your cash flow and multiplies your capital over time.

Jump to CalculatorThe "Velocity" Secret

Imagine two sellers, Alex and Ben. Both have £10,000 and make 10% ROI per sale.

- Alex (Slow Cycle)

Takes 3 months to buy, prep, and sell. Turns cash 4 times/year.

- Ben (Fast Cycle)

Fast prep & shipping. Turns cash 6 times/year.

The Result? With the exact same capital, Ben makes 60% more profit annually just by moving faster.

The "Dead Money" Trap

Every day your stock sits in a box, your money is dead.

The Power of Compounding

In Amazon FBA, you don't just earn profit; you reinvest it. This creates a "snowball effect."

The faster you roll the snowball (Prep & Sell), the bigger it gets.

A delay of just 6 days in prep doesn't look like much on a calendar.

But over 4 years, those 6 days prevent your snowball from rolling dozens of extra times.

Compounding Calculator

Simulate how reducing Prep Time accelerates your wealth over 4 years.

1. Your Baseline

Initial inventory budget

Assumes 60% reinvestment

2. Time Factors (Days)

Supplier to Prep Center

Wait time at FC

Days to sell out stock

Projected Growth (4 Years)

| Metric | Fast Prep (1d) | Slow Prep (7d) |

|---|---|---|

| Full Cycle Length | 43 Days | 49 Days |

| Inventory Turns / Year | 8.5 | 7.4 |

| Capital Year 1 | £165,000 | £153,000 |

| Capital Year 4 | £745,000 | £550,000 |

By waiting 6 extra days for prep, over 4 years you lose:

We Control The FBA Prep Variable

Standard Prep SLA

For standard shipments received before cutoff. We move fast so your money moves fast.

Amazon Compliant

Labelling, FNSKU, packaging and paperwork done exactly to Amazon standards.

Status Updates

Shared sheets and real-time data so you know exactly when stock leaves us.